Sent from my Verizon Wireless BlackBerry

From: "Institute for New Economic Thinking" <Institute_for_New_Economic_Think@mail.vresp.com>

Date: Sat, 24 May 2014 22:07:04 +0000

To: <mainandwall@hotmail.com>

ReplyTo: "Institute for New Economic Thinking" <reply-31e65e9cc8-92ee001bde-f1a6@u.cts.vresp.com>

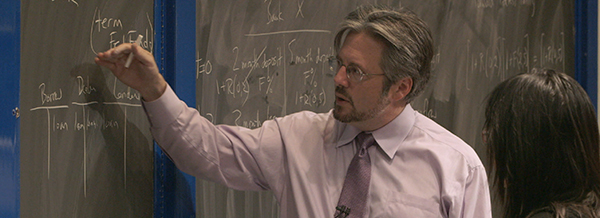

Subject: Special Encore: FREE Money and Banking Course

View this email in a browser | Forward this message to a friend  | | | | Missed last year's course? Interested in learning some new economic thinking? Want to spot the next financial crisis before it’s too late? Then sign up for this FREE online class on The Economics of Money and Banking! After taking the course, you will be able to understand everyday financial discourse at a high level. The class will give you extensive knowledge of how money markets work and is designed to give you the tools be able to spot the next crisis before it hits. You’ll learn what Professor Mehrling calls “the money view,” which will teach you the key institutions that underlie the financial system and give you ideas for how they could be reformed to prevent another collapse. Register Now The last three or four decades have seen a remarkable evolution in the institutions that comprise the modern monetary system. The financial crisis of 2007-2009 is a wakeup call that we need a similar evolution in the analytical apparatus and theories that we use to understand that system. Produced by the Institute for New Economic Thinking, this course is an attempt to begin the process of new economic thinking, by reviving and updating some forgotten traditions in monetary thought that have become newly relevant. Three features of the new system are central. Most important, the intertwining of previously separate capital markets and money markets has produced a system with new dynamics as well as new vulnerabilities. The financial crisis revealed those vulnerabilities for all to see. The result was two years of desperate innovation by central banking authorities as they tried first this, and then that, in an effort to stem the collapse. Second, the global character of the crisis has revealed the global character of the system, which is something new in postwar history but not at all new from a longer time perspective. Central bank cooperation was key to stemming the collapse, and the details of that cooperation hint at the outlines of an emerging new international monetary order. Third, absolutely central to the crisis was the operation of key derivative contracts, most importantly credit default swaps and foreign exchange swaps. Modern money cannot be understood separately from modern finance, nor can modern monetary theory be constructed separately from modern financial theory. That's the reason this course places dealers, in both capital markets and money markets, at the very center of the picture, as profit-seeking suppliers of market liquidity to the new system of market-based credit. Register Now | | © 2014 The Institute For New Economic Thinking | All Rights Reserved. | |

Click to view this email in a browser

Please do not reply to this message. This email was generated automatically and responses are not monitored. If you would like to be removed from this list, please click "Remove Me" below: Remove Me |

Institute for New Economic Thinking

300 Park Ave South

5th Floor

New York, New York 10010

US

Read the VerticalResponse marketing policy. |  |